Shortfall indemnity

Business interruption

Mechanical breakdown

Property damage

Mitigate ESG project risk

Kellclair is an insurance intermediary that underwrites ESG building projects, specialising in energy efficiency, decarbonisation, and energy generation retrofits. This allows risk to be transferred off-balance sheet while predicted milestones are guaranteed.

Transparent, technology-led approach

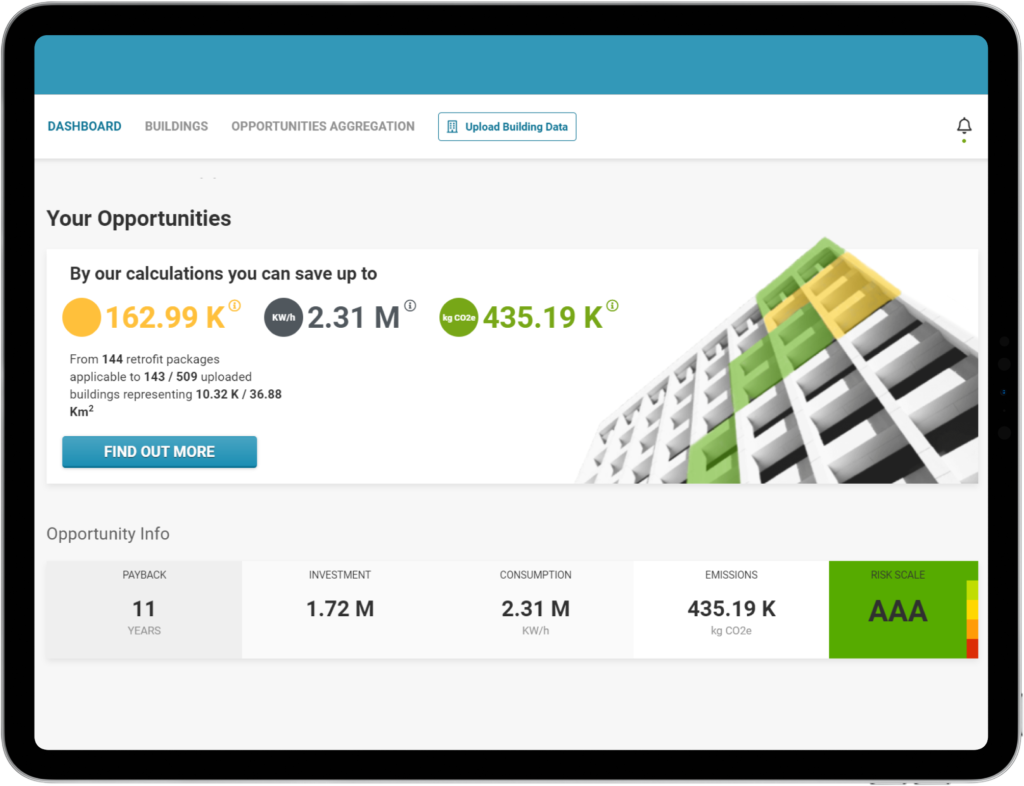

We leverage AI to scrupulously analyse the likelihood and magnitude of project underperformance. Data assessed is visible to building stakeholders and points of concern are surfaced via a collaborative dialogue.

Rigorous due diligence

Technology warranty

Contractor experience

Location of build

Building occupancy

Funder’s balance sheet

Scale of project

Enhanced funding terms

Insurance approval depends on the continuous metering and monitoring of implemented energy efficiency, decarbonisation, and generation measures. This validates loans' usage and enables lenders to access efficient, long-term capital.

Backed by an

A-rated insurer

Kellclair has partnered with property and casualty insurer AmTrust to co-develop policies that safeguard ESG building projects. A world-leading organisation, AmTrust has over 20 years’ experience crafting bespoke risk management solutions. The company has been rated “A-” with a Financial Size of “XV” by A.M. Best.

Policy approval in days

AmTrust’s insurance criteria is integral to each stage of ESG project development. Our climate tech partner, Tallarna, first assesses risk of underperformance at the project design and development stages before Kellclair undertakes due diligence ahead of contracting. With all parties speaking the same language, policy approval takes days instead of months.

Holistic building protection

Kellclair's granular knowledge of a project's risk potential enables us to offer complementary policies to further safeguard success, such as Property Insurance, Contractors Insurance, Legal Liability Insurance, and Professional Liability Insurance.